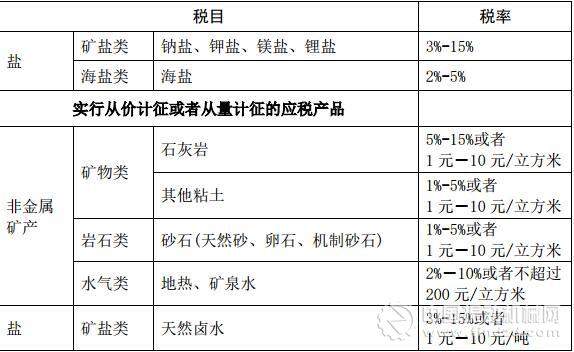

The Resource Tax Law will be promulgated soon. The tax rate of sand and stone (natural sand, pebble, machine-made sand) will be 1%-5% or 1-10 yuan/cubic meter.

On November 21, 2017, the Ministry of Finance and the General Administration of Taxation, together with relevant departments, drafted the Resource Tax Law of the People's Republic of China (Draft for Soliciting Opinions) (hereinafter referred to as Draft for Soliciting Opinions). Among them, the standard of resource tax on sand and stone (natural sand, pebble, machine-made sand) is stipulated, and the resource tax of 1%-5% or 1-10 yuan/cubic meter is levied. For mineral products mined from depleted mines, 30% resource tax will be reduced; for mineral products mined from low-grade mines, tailings and waste rocks, 20% resource tax will be reduced.

01: A resource tax of 1%-5% or 1-10 yuan/cubic meter is levied on sand and gravel.

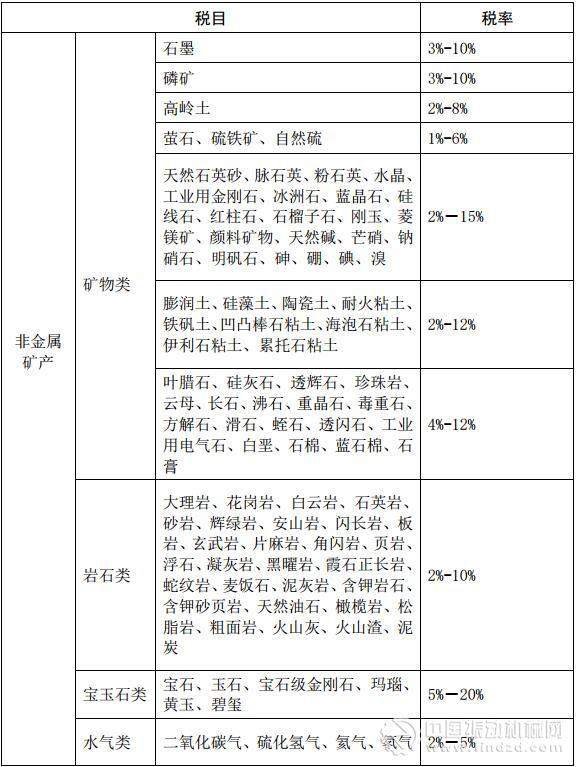

When carrying out the reform of ad valorem taxation of resources tax, the Ministry of Finance and the General Administration of Taxation have listed more than 20 major mineral products tax items, and other mineral products tax items are determined by the provincial people's governments. In order to maintain the standardization and seriousness of the tax law, according to the detailed classification of mineral resources stipulated in the Detailed Rules for the Implementation of the Mineral Resources Law of the People's Republic of China, the Table of Tax Rates of Resources Tax Items annexed to the Draft for Solicitation of Opinions unifies the four categories and 146 categories of energy minerals, metallic minerals, non-metallic minerals and salts. For newly discovered mineral products, the State Council shall put forward proposals on taxation items and tax rates, which shall be submitted to the Standing Committee of the National People's Congress for decision. Among them, non-metallic minerals, minerals, limestone, 5% - 15% or 1 yuan - 10 yuan / cubic meters; non-metallic minerals, rocks, sandstones (natural sand, pebbles, machine-made sand), 1% - 5% or 1 yuan - 10 yuan / cubic meters.

02: 20% reduction in resource tax on mineral products mined from tailings and waste rocks

The draft solicits opinions basically continues the Provisional Regulations and the policy provisions of resource tax reform, and clarifies four situations of tax reduction and exemption:

First, considering the difficulty and high cost of mining in the depletion period, the mineral products mined in the depletion period are recognized by the competent departments of land and resources, and the resource tax is reduced by 30%.

Secondly, in order to improve the comprehensive utilization rate of resources, mineral products mined from low-abundance oil and gas fields, low-grade mines, tailings and waste rocks are recognized by the competent departments of land and resources, and the resource tax is reduced by 20%.

Thirdly, considering the technological characteristics of oil and gas production and transportation, the oil and gas used for heating in the process of crude oil extraction and transportation within the oil field are exempted from tax.

Fourthly, considering the complexity of deep-water oil and gas exploration and development technology, large investment and high risk, in order to support deep-water oil and gas exploration and development, 30% resource tax is reduced from oil and gas exploited in deep-water oil and gas fields.

In addition, the State Council may, according to the needs of national economic and social development, provide for other exemptions or reductions in resources tax and report them to the Standing Committee of the National People's Congress for the record.

03: On the Target of Taxation

Provisional Regulations stipulate that the object of resource tax is raw minerals and salt of mineral products. Considering that most mining enterprises implement integrated production of mining and mineral processing and mainly sell mineral processing products, the reform policy of ad valorem taxation of resources tax is clear, and the object of resource tax is raw ore or mineral processing products. For this reason, the draft for Soliciting Opinions stipulates that the object of resource tax is mineral products and salt, and mineral products refer to raw ore and mineral processing products.

04: About the method of levying and the amount of tax payable

After the comprehensive implementation of the resource tax reform, ad valorem levy has been applied to most taxable products, and ad valorem levy or ad valorem levy shall be determined by the provincial people's government according to the actual situation for a few taxable products which are scattered and difficult to control.

The Draft Request for Opinions stipulates that for taxable products subject to ad valorem taxation, the taxable amount shall be calculated by multiplying the sales volume of taxable products by the specific applicable proportional tax rate; for taxable products subject to ad valorem taxation, the taxable amount shall be calculated by multiplying the sales volume of taxable products by the specific applicable quota tax rate. Among them, the sales volume or sales volume of taxable products shall be determined according to the different forms of taxable products sold by taxpayers, respectively, according to the sales volume or sales volume of raw ore, mineral processing and salt sold by taxpayers.